Listen To Article

Listen To Article

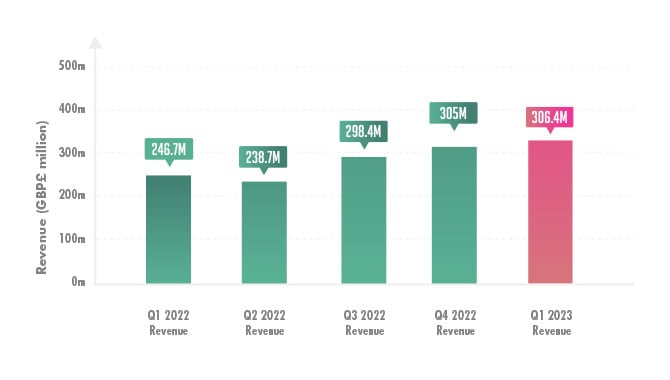

Kindred posted its Q1 report, showing total revenue of £306.4m ($381.7m) – up from the £246.7m it posted in Q1 2022. Meanwhile, its EBITDA totalled £47.3m, a significant increase on 2022’s £22m.

Furthermore, its profit before tax was up 300%, recording £30.4m for Q1.

Looking at its revenue for Q1 2023 against its revenue over the four quarters in 2022, Kindred has already beaten 2022’s record quarter – with Q4 2022 recording £305m in total revenue.

Kindred CEO, Henrik Tjärnström, commented on the results, saying: “The first quarter of 2023 has seen encouraging improvements in both revenue and profitability, with the underlying EBITDA margin increasing to 16%. The cost optimisation initiatives previously communicated have been implemented during the quarter; however, there is a lag before we see the full effect on the numbers.

“The World Cup once again proved to be a strong customer acquisition event and we managed to keep customers engaged into the first quarter this year with 1.6 million active customers for the quarter, an increase of 18% compared to the same period last year.

“This strong activity has put us in a good position for the second quarter, where we will see many more major football league fixtures than usual due to the knock-on impact of the Winter World Cup on football league scheduling.”

The revelation that Kindred has initiated a strategic review, essentially meaning that the Board of Directors is considering a sale of the company, may come as a surprise to onlookers after such positive Q1 results.

The investment bank and financial advisors that will assist and facilitate the sale have been named as PJT Partners, Morgan Stanley & Co. International plc and Canaccord Genuity.

The share price also rose following the dual Q1 and review announcement, rising to SEK 124.50 ($12.07).