Listen To Article

Listen To Article

Unibet owner Kindred Group has announced plans to exit the US market following the release of its Q3 results. By the end of Q2 next year, the company intends to generate annual gross cost savings of £40m ($50.8m); by reducing 300 employees and consultants to focus on core markets and generate growth there.

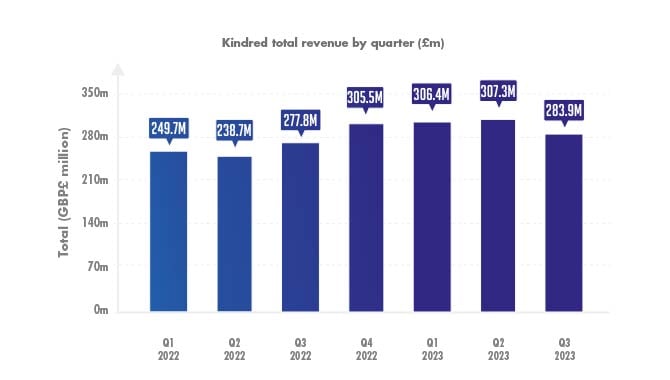

In its Q3 results, Kindred noted revenue growth of 2% at £283.9m, with year-to-date (YTD) total revenue at £897.6m, an 18% increase from this period last year. Gross winnings revenue reflected a similar growth trajectory, up 1% this quarter and 16% this YTD.

Most notably, in the year so far underlying EBITDA has increased 64%, yet in Q3 grew only 6% from this time last year. This pattern of Q3 growth not matching that of the year so far was addressed by Kindred interim CEO Nils Andén, who said: “During the third quarter, we experienced continued growth in our casino segment and strengthening positions in the key Netherlands and UK markets.

“However, this growth was tempered by ongoing regulatory challenges in select core markets and an impacted sportsbook performance.

“The strategic review initiated by the Board remains ongoing and we continue to advance a number of options to deliver shareholder value.”

The company’s North American departure is set to allow resources to be reallocated to core market growth initiatives. Some of these initiatives are set to include local casino brand extensions and a push for exclusive content across various products.

Andén described the move as one that: “puts us in a stronger position to secure long-term growth for Kindred across our locally regulated core markets.”