Entain CEO Jette Nygaard-Andersen and CFO Rob Wood were on hand to speak to analysts during the operator’s H1 and Q2 conference call, where they discussed Entain’s H1 results, as well as its HMRC regulatory settlement.

The helicopter view

Nygaard-Andersen was keen to highlight that Entain’s “core underlying business remains healthy” and that she is “pleased about upcoming Brazil regulation.” On LatAm, she added: “We are now starting to see the benefits of improvements we’ve made in Latin America, including the 365scores acquisition.”

The CEO also explained that “retail continues to perform impressively” but highlighted that records were once again broken online, with a 23% year-on-year rise showing “sustainable growth.”

She further mentioned that BetMGM also achieved profitability for Q2 and is on track for sustainable profitability for H2 onward.

Meanwhile, CFO Wood did discuss that Australia and Brazil saw revenue falls.

24/7 – 365scores

There was, however, plenty of focus on Entain’s £120m ($153.1m) acquisition of 365scores in April.

According to CFO Wood and CEO Nygaard-Andersen, the 365scores acquisition is a “little different” – with the brand boasting 18 million monthly active users.

The betting/media convergence here will enable Entain to utilise proprietary data, improving its knowledge of user behaviour, according to its executives.

Wood went as far as describing the deal as “probably one of our most attractive acquisitions to date.”

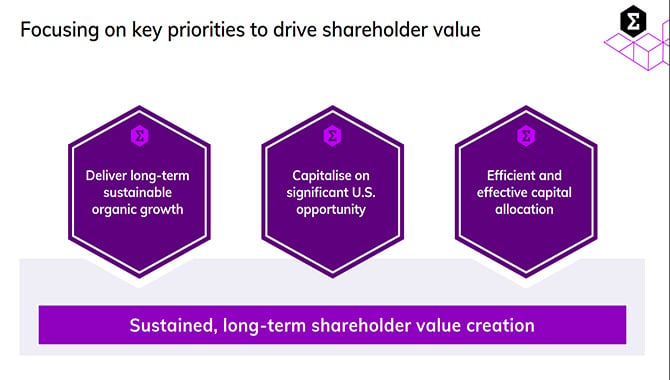

A slide from Entain’s H1 presentation.

The Americas

Despite the aforementioned falls in Brazil, Nygaard-Andersen is naturally optimistic, given the recent positive update on sports betting regulation.

She said: “There’s lots going on Brazil. We’re still optimistic about coming online early next year. We reset our marketing approach during H1, attracting a more sustainable customer base. Integration with 365scores will customise our offering based on the data. There’s a lot of noise in the market but you can expect the second half.”

Discussion followed about North America and Angstrom Sports, another of Entain’s recent acquisitions, which offers a “unique simulation-based pricing model.”

Nygaard-Andersen also mentioned the expected impact of single-game parlays in the US, suggesting Angstrom will improve Entain’s sports product to drive market share. The main emphasis here was that it is “not only about the Super Bowl and March Madness” but the organisation’s “in-house capabilities being a key differentiator” moving forward.

Returning to Latin America, she added: “Colombia is an example of organic growth. Very often, the fastest way into a new market is to acquire one of the strongest brands.”

The competition

The big recent news that ESPN Bet will launch later this year was naturally put to the Entain leadership, just as it was to Flutter Entertainment CEO Peter Jackson,

Nygaard-Andersen, though, was unfazed. She responded: “The market is becoming more and more competitive/consolidated. We remain confident with BetMGM and are really focused on our new products, as well as investing in our iGaming products.”

Margin improvement expected from bringing Angstrom’s software in-house was referenced as a reason for calm here.

Equally, when asked about FanDuel and DraftKings, the Entain CEO said: “In iGaming – yes, we know that we have competition. But we never focus on one competitor and when I look at the numbers for iGaming market share, I take comfort in the fact it has been pretty stable even when we’re seeing new competition.

“BetMGM is constantly benefiting from what Entain is doing, with innovative new games, live games in casino. Market share is stable, we are not standing still but we are not focused on any one single competitor.”

Another slide from Entain’s H1 presentation suggests a more disciplined approach, again distancing itself from the GVC days. Although acquisitions are still going ahead aplenty at Entain (as they still did during H1), the operator is presenting the case for these now being more calculated deals.

A geographical breakdown

Towards the end of the call, CFO Wood broke down some key areas for Entain, including the UK, Australia, Italy and the Netherlands.

He explained: “In the UK, the comparatives are quite challenging at the moment given the strength of implementation of affordability measures and other factors.

“In Australia, there were market share gains but we were more neutral on a net gaming revenue level. Sportsbet (a competitor) has invested more on marketing year-on-year by comparison.

“Eurobet was flat online in Italy, with some market share gains in retail.

“When we acquired BetCity in the Netherlands, it was 20% market share, but we think it has dipped to late teens after the entrance of Unibet into the market (competitor).”

Additional information on the HMRC settlement

Finally, Nygaard-Andersen echoed Chairman Barry Gibson with a quick comment on Entain’s HMRC settlement in Turkey. She added: “This relates to a previous management team before my time. I just want to stress we lead a very different business today.”

And Wood confirmed that payments for this settlement would involve equal monthly installments over a four-year period.

He clarified: “Whether the first month starts this calendar year, we’re not sure, but for modeling purposes, it’s easier to say from January 2024.”